Guide

CFO's Ultimate Guide to Successfully Transitioning to SaaS

The way a company monetizes its software has a huge impact on business success, growth and profitability.

CFOs and financial leaders strive to make their software companies even more successful and set them up for growth. Moving away from one-time perpetual license sales to recurring revenue models, as well as transitioning on-premises offerings to SaaS are top of the strategic project lists for many technology CFOs.

The CFO’s goals:

- Grow company revenue and overall valuation, with recurring revenue worth far more than one-time revenues,

- Take products to market quickly to capture new revenue streams and grow into new markets,

- Increase the company valuation through strong renewal rates and profitable pricing strategies

- Drive profitability and enable long-term investment.

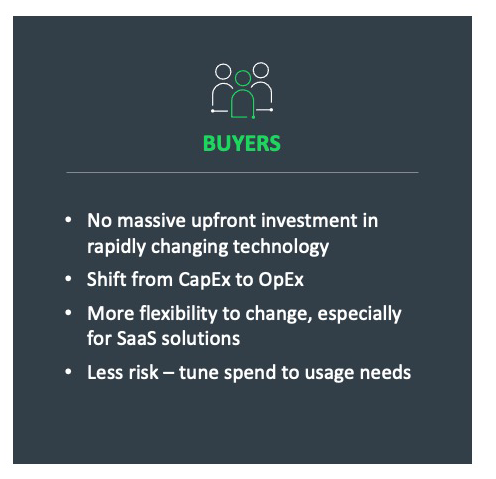

When a software company offers recurring revenue models, it also benefits customers. The finances of it are appealing. Acquisition cost of the software drops, allowing customers to try the software or adapt their usage in line with needs, without a massive upfront investment in rapidly changing technology. The customer’s expense also shifts from CapEx to OpEx.

Recurring revenue models lend themselves well to a software-as-a-service (SaaS) deployment model where the supplier provides the full solution and the customer uses the solution without the expense of hosting, maintenance, or updates.

Many software suppliers will continue to offer on-premises deployments for some time, but the trend toward SaaS is clear. As found by IDC, subscription public cloud services, including SaaS and platform-as-a-service (PaaS) models, show an anticipated growth in compound annual growth rate (CAGR) of 18.8% between 2020 and 2025, jumping from $240.9M to $570.1M in that time.

This “SaaSification” of products provides benefits for the supplier (including recurring revenue and scalable deployments) and customers (such as elimination of the need to host or manage the software, easy upgrades and role-based personas) alike. SaaS deployment models also make it easier to measure and monitor customer adoption and engagement trends, allowing suppliers to proactively support and strengthen the customer relationship for ongoing subscription renewals.

The transition to SaaS is optimized when CFOs, senior finance staff, product managers and the teams working with them understand the functionality, financial implications and benefits of this deployment model.

“58% of total software revenue will be from the SaaS delivery model by 2025.”

Optimize Software and Services Deployment with SaaS

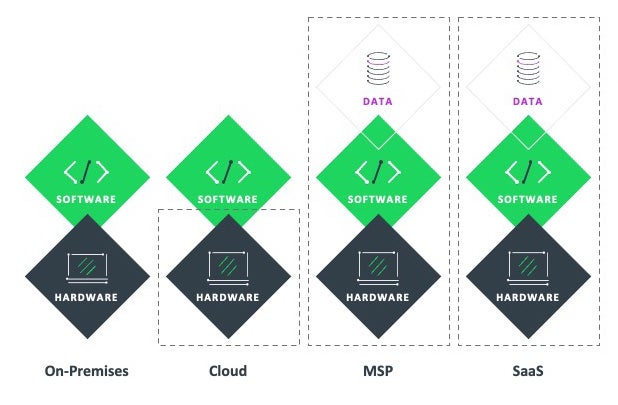

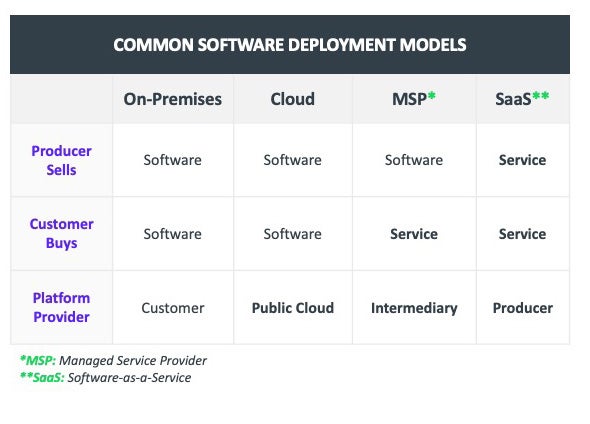

SaaS is a deployment (delivery) model, in which a software supplier chooses to host the software and provide it as a service to the end customer. The burden of running the service is entirely with the supplier. Compared to on-premises deployments, SaaS is more expensive for the supplier to run, because the supplier is responsible for all costs related to hosting and management. The end customer has nothing to do with the hosting, maintenance, or updates.

Contrast this with other deployments. With on-premises software, the customer receives the binaries and manages everything else themselves. With cloud deployments, solutions run in the cloud (as opposed to a local data center), but the solution may be managed by the end customer.

SaaS solutions usually run in the cloud, but not all cloud deployments are SaaS.

Subscription lends itself well to the SaaS model. The subscription monetization model provides the recurring revenue stream from the customer that is necessary in order to maintain the service.

Insight

SaaS and subscription, two current trends in software, go hand-in-hand, but are not the same.

- The Software-as-a-service (SaaS) deployment (or delivery) model refers to how the software is deployed and delivered to the end-customer.

- The subscription monetization model refers to how that software is monetized.

- When multiple models are used together, the result is a hybrid model.

Select the Most Beneficial Software Monetization Models

Monetization models fall into two categories: recurring and one-time (non-recurring):

Recurring:

- Outcome (aka “value-based”) is billed based on measurable customer value. It is a logical model, similar to a contingency fee, but more difficult to implement, measure and budget for (for both the supplier and the buyer).

- Usage-based is billed based on actual usage of the software.

- Subscription (aka “term licensing”) is billed monthly or yearly. It is a much simpler model than other recurring models. Subscription delivers a steady revenue stream.

One-time:

- Perpetual (aka “perp”) involves a large upfront investment, which does not recur. Because it is a lumpy revenue stream, perpetual is much less valuable to the company that’s selling it.

Subscription monetization is popular and desirable because it delivers advantages to suppliers and buyers of software. For suppliers, subscription provides more visibility, stability, and predictability in the revenue stream. These attributes benefit the company valuation, strengthening the supplier’s ability to continually invest in the product. When moving to SaaS, the software supplier absolutely needs a recurring revenue stream from the customer in order to maintain the service. Subscription is the ideal way of delivering this recurring revenue to the supplier.

Subscription appeals to buyers because there is no large upfront investment—an advantage when buying technology that changes rapidly. Subscription is an OpEx, not a CapEx, expenditure. Because it can be changed as needs change, subscription is more flexible and less risky.

MOTIVATION FOR BUYERS AND SUPPLIERS: THE SUBSCRIPTION WHY

Prepare for the Transition

When moving to subscription—an economic model tied to the duration of a contract—as the logical monetization model for SaaS deployments, there’s a time of transition with short term pain for long-term gain.

Shifting away from predominantly perpetual licensing (where revenues are recorded up front) will lead to an initial revenue dip. This initial revenue uncertainty is the impact of changes in pricing and predictability (for adoption and renewal rates). With that transition, the focus may change on how the finance team thinks about cash flow rather than GAAP revenue recognition.

Once implemented, subscription becomes a more predictable revenue stream, making it easier to forecast the business and to manage investors’ expectations, long-term. This short-term tradeoff is often easier for private companies to withstand; the change usually makes sense for public companies, as well.

Several important metrics, which may or may not be new to companies shifting to subscription, are:

- Annual contract value (ACV): The value recognized in a single year of a multi-year subscription.

- Annual/monthly recurring revenue (ARR/MRR): The sum of all subscription revenue in a year/month.

- Billings: The number on the invoice that goes out the door to the customer, billings occur when the actual invoice is sent, based on the contract terms.

- Customer acquisition cost (CAC): The cost to acquire a new customer (e.g., marketing expenses), which in turn starts a new recurring revenue stream.

- Lifetime value of a customer (LTV): the total expected revenue over the lifetime of a customer relationship. The LTV must be larger than the CAC.

- Revenue retention: revenue change for existing customers over a period of time.

ARR is the single most critical metric for a subscription company. It brings all the major elements in the business together: renewal; visibility into components of renewals (such as churn and price increases); and capturing new business (with components including new logo revenue and upsell revenue from existing customers). Growth in ARR indicates a healthy software business. Examining ARR can also help uncover retention issues; if existing customers aren’t renewing, ARR will be stunted or even negative.

Billings become even more important than they were before. Because billings is a metric more closely tied to the actual cash flow of the company, revenue (an accounting metric caught up in the GAAP revenue recognition role) becomes arguably less important than billings.

Drive Long Term Value

Customer success and retention are most critical for the ongoing success of a software company. Customer retention is the key driver of ARR and long-term value, so the supplier must be customer-centric, focusing on customer health to minimize net churn.

Contract length can help solidify long-term value. Typical billing for subscription (for SaaS or other deployment models) is through upfront installments, usually billed annually. Most common is the industry-standard three-year contract; the customer pays year one upfront at the beginning of the contract, pays year two on the one year anniversary of the contract start date, then pays for year three on the two-year anniversary of the contract start date.

Strong retention rates are crucial. The renewal rate and the gross retention rates percentages—signals of how much value customers receive from the software they license from the supplier—are the best indicators of customer health and customer success.

Look at retention rates by each product line or by type of software, then in aggregate for the company a whole. Retention can be measured in multiple ways and should be evaluated from multiple angles:

- In terms of revenue: gross revenue retention rates.

- At customer level: the renewal rate percentage measures renewals of the contracts that are up for renewal that year. A significant benefit of a contract renewable every three years, is that it has a built-in 100% renewal rate in year two and three.

Gross retention rates above 90% generally indicate a healthy product and healthy customer success rates.

“The technology to move to subscription is the ... easier part. Getting people to change, getting your sales process to change, getting your customers to change—that’s the hard part.”

Adjust Operations for a Customer-Centric Organization

To achieve a customer-centric model, a supplier must embrace a customer success mentality to ensure ongoing renewals. LTV must always remain larger than CAC. This requires organization-wide buy-in, likely requiring a shift in operations. Suppliers need to break down silos and align all roles—sales, services, support, customer success and renewals—with a customer-centric model, working together to drive customer value.

Steps for a customer-centric organization include:

- Provisioning: Enabling customers to deploy your solution rapidly.

- Onboarding: Supporting the customer journey.

- Driving success: Analyzing account health and renewal risk.

- Renewals & upselling: Monitoring consumption and creating transparency.

Software suppliers should rely on more than anecdotal evidence about renewals and about why churn is taking place. Operational requirements include measuring and tracking ARR on a monthly basis, identifying customer cohorts that are (or aren’t) successful to identify where churn is happening, understanding software usage to predict (and prevent) churn, and proactive renewal management.

Advanced product usage analytics is the most effective way to collect quantitative data. That data can then be combined with qualitative methods (e.g., surveys, interviews, sales feedback and support calls) for a comprehensive view of how customers are using the product.

Frequently Asked Questions (FAQs)

SaaS (Software-as-a-Service) is a delivery model where software is hosted by the supplier and accessed by customers via the cloud. For CFOs, SaaS enables predictable recurring revenue, reduces upfront costs for customers, and supports scalable growth. It also shifts expenses from CapEx to OpEx, aligning better with modern financial strategies.

Subscription monetization provides steady, recurring revenue streams that improve financial forecasting and company valuation. It allows suppliers to invest continuously in product development and customer success. Compared to one-time licensing, subscriptions offer more flexibility and lower risk for buyers.

Important metrics include ARR (Annual Recurring Revenue), MRR (Monthly Recurring Revenue), CAC (Customer Acquisition Cost), LTV (Lifetime Value), and billings. These metrics help CFOs understand revenue health, customer retention, and profitability, especially during the shift from perpetual to subscription models.

Transitioning to SaaS often involves short-term revenue dips and operational changes. CFOs must manage cash flow differently and align teams around customer success. The hardest part is not the technology—it’s changing internal processes, sales strategies, and customer expectations.

SaaS models allow suppliers to monitor usage and engagement, enabling proactive support and renewal strategies. Long-term contracts and high gross retention rates (above 90%) signal strong customer satisfaction and product value, which are essential for sustainable growth.

SaaS is a deployment model—how software is delivered—while subscription is a monetization model—how software is priced and billed. They often work together but are not the same. SaaS can be delivered via subscription, usage-based, or outcome-based pricing.

ARR consolidates key revenue components like renewals, upsells, and churn. It reflects the health of the business and its growth trajectory. A rising ARR indicates strong customer retention and successful acquisition strategies, making it vital for investor confidence.

CFOs should align finance, product, and customer success teams around shared goals. They must track relevant metrics, forecast accurately, and support operational changes. Leveraging analytics and customer feedback helps refine strategies and improve retention.

Customer success is central to SaaS growth. It ensures customers achieve value, which drives renewals and upsells. A customer-centric organization monitors health scores, usage patterns, and feedback to reduce churn and maximize lifetime value.

Hybrid models combine SaaS deployment with multiple monetization strategies like subscription, usage-based, or perpetual licensing. This flexibility allows companies to cater to diverse customer needs while optimizing revenue streams across product lines.

Resources

Webinar

6 Steps to Launching Usage-Based Pricing for SaaS and AI

Tuesday, February 17, 2026

In this webinar, Nicole Segerer, General Manager at Revenera, will share this practical 6-step framework for launching usage-based pricing in SaaS, AI, and even on-premises products.

Webinar

Software License Compliance Best Practices

Wednesday, February 25, 2026

Join our quarterly webinar series, "Software License Compliance Best Practices," where we'll explore the latest strategies and methodologies for ensuring compliance and addressing piracy and overuse.

Report

AI Monetization, Done Right: A Practical Guide for Product and Pricing Leaders

This guide outlines how product and pricing leaders can achieve sustainable AI profitability by aligning pricing, usage, and cost structures.

In-person Event

Revenera Connect 2026: San Jose

Thursday, March 19, 2026

Register for Revenera Connect 2026 in San Jose! The event will offer new insights and expertise into the latest monetization and pricing trends, practices and technologies and provide you with new ideas for how to make your business more successful in 2026.

Webinar

SoftSummit 2026

April 28, 29 & 30 (Tuesday, Wednesday & Thursday)

Report

2026 Frost & Sullivan Product Leadership Recognition Report

This exclusive report reveals how Revenera is shaping the future of software monetization, compliance, and lifecycle management.

Want to learn more?

See how Revenera's Software Monetization platform can help you take products to market fast, unlock the value of your IP and accelerate revenue growth.