Webinar

Software Usage Analytics for Desktop Applications

Learn how desktop software vendors use product analytics to drive roadmap, pricing, and SaaS strategy decisions.

Original Air Date: June 21, 2021

Overview

If you're a software producer navigating the complexities of desktop applications in a SaaS-driven world, this webinar is a must-watch. Join Daniel Barrett, Solution Engineer, and Michael Goff, Principal Product Marketing at Revenera, as they unpack how software usage analytics can transform your product strategy.

You'll learn how to uncover hidden user behaviors, identify which features drive the most value, and make smarter decisions about pricing, packaging, and roadmap prioritization. Whether you're maintaining legacy on-prem products or planning a SaaS migration, this session offers practical insights to help you stay competitive. Discover how leading vendors are using data to improve customer retention, accelerate trial conversions, and optimize user experience.

Real-world examples, including a case study from TechSmith, show how analytics can drive measurable business outcomes. Plus, you'll get expert guidance on whether to build or buy your analytics solution—and how to get started quickly. If you're ready to monetize what matters and deliver more value to your users, this webinar will show you how.

Recap

Key Themes and Takeaways

Why Desktop Usage Analytics Still Matter

Despite the growing dominance of SaaS, desktop applications remain a vital part of many software vendors’ portfolios. Michael Goff emphasized that while SaaS revenue is increasing, on-prem software is far from obsolete. Many vendors are maintaining or even expanding their desktop deployments, making it essential to understand how these products are being used to stay competitive and make informed decisions.

SaaSification and Hybrid Deployment Trends

The webinar explored how vendors are adapting to the shift toward SaaS, with many adopting hybrid models. A live poll revealed a balanced mix of on-prem, SaaS, and hybrid deployments among attendees. This underscores the importance of usage analytics across all environments, especially as customer expectations evolve to demand continuous updates and transparency—even from desktop products.

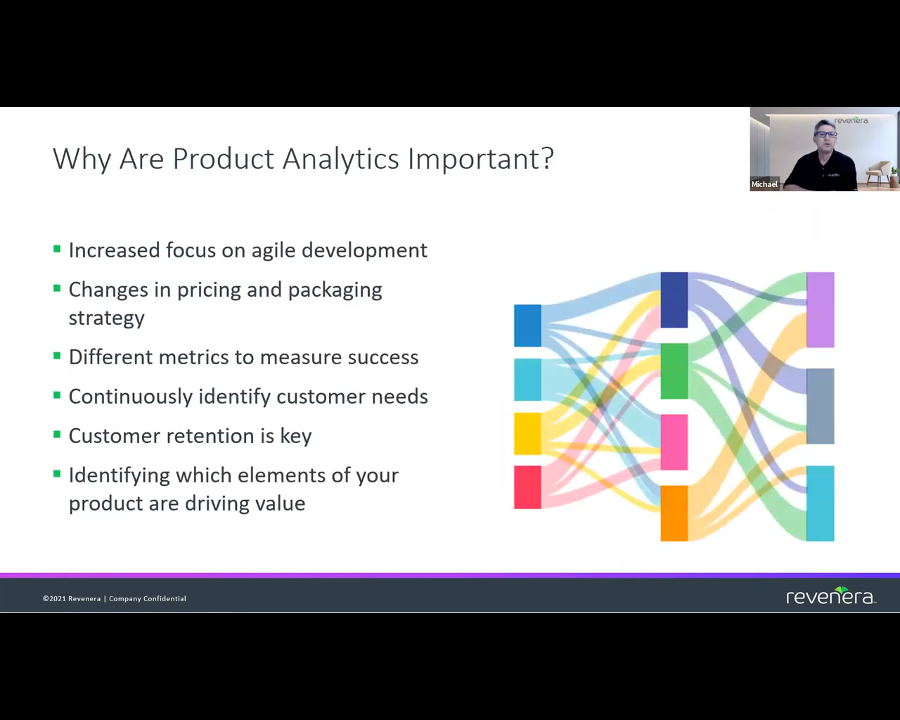

The Value of Usage Data in Product Strategy

Daniel Barrett and Michael Goff demonstrated how usage analytics can uncover which features are most valuable, which are underused, and how different user personas engage with the product. These insights help product teams prioritize development, refine pricing and packaging strategies, and align roadmaps with actual user behavior.

Real-World Use Case: TechSmith

A standout case study from TechSmith showed how usage analytics can drive measurable business impact. By identifying unexpectedly popular features and localizing survey outreach, TechSmith improved user experience and dramatically increased survey response rates. Their product, marketing, and sales teams all leveraged the data to enhance engagement, conversion, and retention.

Build vs. Buy: Choosing the Right Analytics Solution

The speakers discussed the trade-offs between building a custom analytics solution and adopting a turnkey platform. While building offers flexibility, it demands significant engineering effort. Turnkey solutions like Revenera’s Usage Intelligence are designed for fast implementation—typically just a few developer days—making it easier to start collecting meaningful data without heavy resource investment.

Crawl-Walk-Run: A Practical Approach to Implementation

Attendees were encouraged to start small by tracking the most critical features first, then expanding over time. This phased approach prevents data overload and ensures that insights are actionable. Most of the effort should go into planning what to track, not coding, allowing teams to iterate and mature their analytics programs effectively.

Overcoming Internal Resistance and Driving Adoption

One audience question focused on how to get internal teams excited about usage data. Michael Goff recommended aligning analytics insights with each department’s goals—such as churn reduction for sales, messaging optimization for marketing, and roadmap validation for product management. Sharing metrics regularly across teams helps build momentum and cross-functional buy-in.

Segmenting Users for Better Feedback

Usage analytics enable smarter customer feedback collection by identifying who is most engaged or who hasn’t discovered key features. This segmentation allows for targeted surveys and interviews, improving the quality of insights and helping teams understand both power users and those at risk of churn.

Speakers

Daniel Barrett

Solutions Engineer

Revenera

Michael Goff

Principal Product Marketer

Revenera

Frequently Asked Questions

Software usage analytics refers to the tracking and analysis of how users interact with a software application. It helps software producers understand which features are used most, how users navigate the product, and where they may be dropping off. This data is critical for making informed decisions about product development, pricing, and customer engagement. For desktop applications, usage analytics can be especially valuable since traditional tracking methods are less common compared to SaaS products.

By identifying which features are most frequently used and which are underutilized, product teams can prioritize enhancements that deliver the most value. Usage data reveals real user behavior, helping teams avoid relying solely on assumptions or anecdotal feedback. This leads to more targeted development efforts and better alignment with customer needs. It also helps determine which features to migrate first when transitioning to SaaS or hybrid models.

Tracking feature usage in desktop applications allows software producers to understand user engagement at a granular level. It helps identify sticky features, discover unused functionality, and segment users based on behavior. These insights can inform UI improvements, training resources, and even monetization strategies. Without this data, teams risk investing in features that don’t drive value or missing opportunities to enhance the user experience.

Usage analytics helps identify which parts of a product deliver the most value, enabling smarter pricing and packaging decisions. For example, if a small set of features drives most user engagement, those can be bundled into premium tiers. It also supports usage-based pricing models by providing the data needed to measure consumption. Ultimately, it helps software producers monetize what matters most to their customers.

Desktop applications often lack built-in tracking capabilities, making implementation more complex than in web-based products. Challenges include manual data collection, limited connectivity, and privacy concerns. However, turnkey solutions designed for desktop environments can simplify deployment and reduce engineering overhead. Planning what to track is often more time-consuming than the actual implementation.

Building a custom analytics solution offers flexibility but requires significant engineering resources and ongoing maintenance. Turnkey platforms are optimized for fast deployment and typically require only a few developer days to implement. They also offer pre-built reporting and segmentation tools, making it easier to extract insights quickly. For most software producers, turnkey solutions provide a faster path to value.

By monitoring user engagement trends, software producers can identify accounts at risk of churn before renewal periods. Low usage or declining activity can trigger proactive outreach from customer success or sales teams. Usage data also helps tailor onboarding and support efforts to improve retention. In subscription models, maintaining engagement is critical to long-term revenue.

Key engagement metrics include daily active users, feature usage frequency, session duration, and user flow paths. These metrics help quantify how users interact with the product and whether they’re getting value. Tracking engagement over time also reveals trends in adoption and abandonment. These insights are essential for improving product experience and customer satisfaction.

Usage analytics enables targeted feedback by identifying which users are most active or have used specific features. This allows teams to send surveys or conduct interviews with the right audience, improving the quality of insights. It also helps avoid asking irrelevant questions to users who haven’t engaged with certain functionality. Combining qualitative feedback with quantitative usage data creates a more complete picture.

To drive adoption across teams, align usage data with each department’s goals. Show sales how it can reduce churn, marketing how it improves messaging, and product how it informs roadmap decisions. Share metrics regularly through internal channels and invite feedback on what data teams want to see. When more people use the data, its value multiplies across the organization.

Resources

Webinar

Software License Compliance Best Practices

Wednesday, February 25, 2026

Join our quarterly webinar series, "Software License Compliance Best Practices," where we'll explore the latest strategies and methodologies for ensuring compliance and addressing piracy and overuse.

In-person Event

Revenera Connect 2026: San Jose

Thursday, March 19, 2026

Register for Revenera Connect 2026 in San Jose! The event will offer new insights and expertise into the latest monetization and pricing trends, practices and technologies and provide you with new ideas for how to make your business more successful in 2026.

Webinar

From Digital Ambition to Business Impact: What It Really Takes to Monetize Software, Data, and AI in Intelligent Devices

Thursday, March 26, 2026

Join analysts, VDC, as they describe how intelligent device manufacturers can make software-led transformation a commercial as well as technical success

Want to learn more?

See how Revenera's Software Monetization platform can help you take products to market fast, unlock the value of your IP and accelerate revenue growth.